Introduction Managing short-term financial needs becomes easier when you spread repayments over a longer tenure. A ₹20,000 Loan For 12…

Introduction Unexpected expenses can arise anytime, medical bills, urgent travel, rent, or sudden repairs. In such situations, a ₹20,000 Instant…

Introduction Need urgent funds for medical bills, rent, travel, or unexpected expenses? A ₹10,000 loan on an Aadhaar card can…

Introduction: One App, Multiple Financial Needs Managing money today shouldn’t mean juggling five different apps for loans, credit checks, insurance,…

The way Indians borrow money has changed dramatically over the last few years. Instead of lengthy bank visits and paperwork,…

Not every financial requirement is a big one, sometimes it’s the small expenses that catch you off guard. A broken…

Introduction Whether it’s funding a home renovation, covering an emergency, or fulfilling a long-awaited dream, borrowing can be a practical…

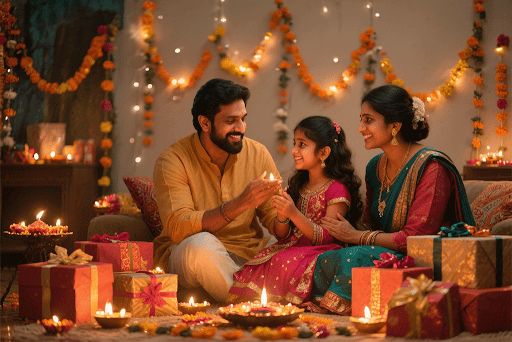

The Spirit of Diwali and Big Dreams Diwali is a season of hopes, celebrations, and new beginnings. From decorating our…

Diwali, the festival of lights, brings joy, celebration, and togetherness. However, with gifting, home décor, travel, and festive shopping, expenses…

Dreaming of giving your home a festive makeover or planning to upgrade your interiors? Whether it’s repainting the walls, buying…

Instant Loan FAQs

What is an instant loan?

An instant loan is a short-term credit option that provides quick access to funds with minimal documentation.

How do instant loans work?

Instant loans are approved based on your details, credit score, and eligibility. Once approved, funds are disbursed directly to your bank account.

What documents are required for an instant loan?

Basic identity, address proof, and bank details are usually required.

Who can apply for an instant loan?

Eligible salaried and self-employed users can apply.

Does taking an instant loan affect credit score?

Timely repayment helps; delays hurt your score.

Can I get an instant loan with low credit score?

Some digital lenders consider alternate eligibility factors.