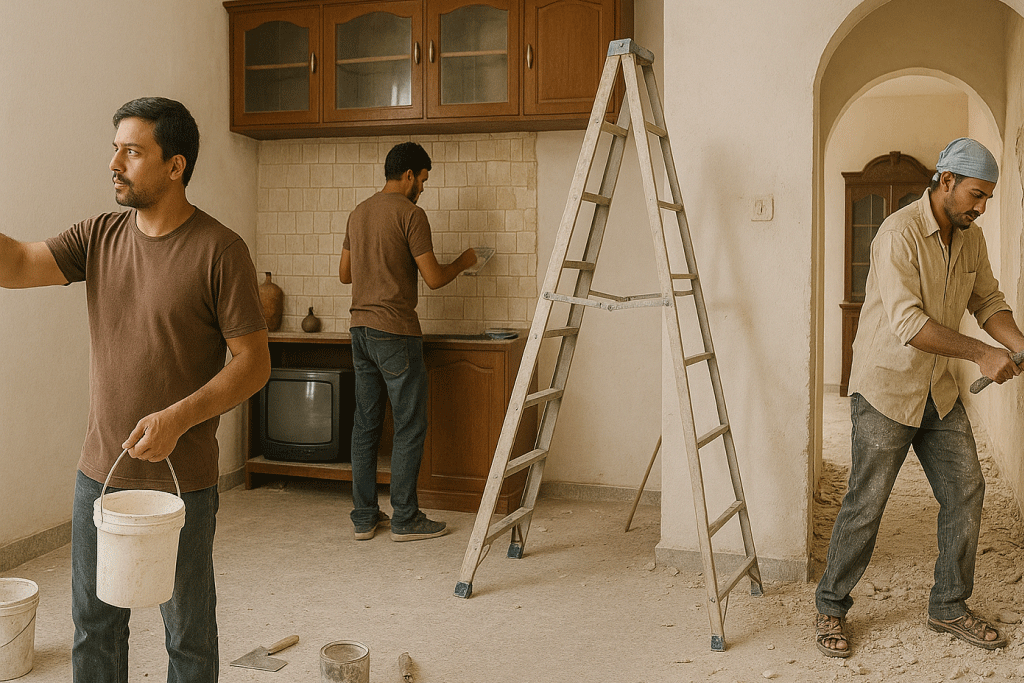

Dreaming of giving your home a festive makeover or planning to upgrade your interiors? Whether it’s repainting the walls, buying new furniture, or adding a modular kitchen, renovations can often come with unexpected costs. Instead of dipping into your savings, a quick and reliable solution is to opt for an instant loan.

With the best instant loan app like FatakPay, you can get funds in minutes to finance your home improvements, all with minimal documentation and complete transparency.

Why Choose an Instant Loan for Home Renovation?

A home renovation loan is designed to make your home upgrade journey simple, stress-free, and financially flexible. Here’s why it’s a smart choice:

- Quick approval: Get funds credited within minutes, ideal for last-minute or festive makeovers.

- No collateral required: Enjoy unsecured credit without pledging any assets.

- Flexible repayment: Choose easy EMIs that fit your monthly budget.

- Preserve your savings: Avoid breaking FDs or using emergency funds.

- Festive-ready: Perfect for Diwali home renovation plans or seasonal upgrades.

Plan Your Renovation Before Taking the Loan

Before applying for a home improvement loan, it’s important to plan your renovation to make the most of your borrowed funds:

- Set a clear budget: List out expected costs; materials, labour, décor, and extras.

- Prioritise key upgrades: Focus on structural or functional areas first, then move to aesthetics.

- Compare vendors: Evaluate different quotations to stay within budget.

- Avoid overspending: Borrow only what’s needed to ensure easy repayments.

- Keep buffer funds: Unexpected costs often arise during renovation projects.

A well-planned renovation not only enhances your living space but also adds long-term value to your property.

Smart Ways to Use Your Loan

A home renovation loan can be used for more than just a fresh coat of paint. Here are smart ways to utilise it:

- Structural upgrades: Fix leakages, rewire old electrical fittings, or repair flooring.

- Furniture and interiors: Buy new furniture or revamp your kitchen and storage.

- Energy efficiency: Switch to solar panels or energy-saving appliances.

- Home automation: Add smart devices for modern living.

- Festive touch-ups: Give your home a glow-up this Diwali with new lighting, upholstery, or décor.

Use your instant loan wisely to enhance both comfort and property value.

How to Apply in Minutes

With FatakPay, applying for a home renovation loan is quick, simple, and completely digital:

- Download the FatakPay App from the Play Store.

- Check your eligibility instantly within the app.

- Upload basic documents such as PAN, Aadhaar, and bank details.

- Choose your loan amount and tenure.

- Receive instant disbursal directly into your bank account.

It’s that easy: no long forms, no branch visits, no waiting.

FAQs

1. What is the maximum amount I can get for home renovation?

FatakPay offers flexible amounts based on eligibility, making it ideal for both small and large home projects.

2. Can I use a personal loan for home renovation?

Yes, a personal loan can serve as a home improvement loan, offering more flexibility and quicker processing than traditional renovation loans.

3. Are there prepayment charges on FatakPay loans?

FatakPay offers transparent terms, with minimal or no hidden fees depending on your loan plan.

4. Is FatakPay a good choice for festive renovation?

Absolutely! With fast disbursals and easy EMIs, FatakPay is perfect for Diwali home renovation or quick upgrades before special occasions.

Renovate Smart, Borrow Smarter

This festive season, make your home shine without financial stress. With FatakPay, you get the best instant loan app experience, quick approval, flexible repayment, and no hidden charges.

Download the FatakPay App and apply for your instant loan today to fund your dream renovation in minutes.