News

International Women’s Day 2026: How Financial Independence Transforms Women’s Lives

Introduction International Women’s Day is more than a celebration, it is a reminder of progress, equality, and empowerment. In 2026, conversations around financial independence for women are stronger than ever. From entrepreneurs and professionals to homemakers and students, women across India are taking charge of their finances. Access to digital banking, investments, insurance, and even

Top 10 Best Loan Apps for Students in India (2026)

Introduction – Why Students in India Need Loan Apps College life comes with expenses, tuition fees, coaching classes, hostel rent, books, gadgets, and daily living costs. While traditional bank loans exist, they often require lengthy paperwork and guarantors. That’s where loan apps for students come in. In 2026, digital lending will make it easier for

Top 10 Best Bikes in India 2026: Price, Mileage & Performance Comparison

Introduction India’s two-wheeler market in 2026 continues to evolve rapidly. From ultra-efficient commuter bikes to powerful top speed bikes in India, buyers now have access to a wide variety of choices across price segments. Whether you are searching for budget friendly bikes for daily travel or exploring performance-oriented machines, selecting the right bike requires balancing

Top 8 Best Cars Below ₹10 Lakhs in India 2026

Introduction Buying your first car is a big milestone. In 2026, the Indian automobile market offers several budget friendly cars in India that combine affordability, mileage, safety, and modern features, all under ₹10 lakhs. Whether you’re looking for the best family car in India under 10 lakhs, a fuel-efficient daily commuter, or a stylish hatchback,

Financial Planning for Beginners in India: Complete 2026 Guide

Introduction Managing money wisely is no longer optional, it is essential. With rising living costs, changing job markets, and increasing financial responsibilities, understanding financial planning for beginners has become more important than ever in 2026. Whether you are a salaried professional, freelancer, student, or small business owner, learning how to plan your finances early can

Personal Loan vs Credit Card for Emergency Expenses

Introduction Emergencies rarely come with a warning. Whether it’s a sudden medical bill, urgent travel, home repairs, or an unexpected family expense, having quick access to funds becomes critical. In such situations, many people face a common dilemma: Should I use a personal loan or a credit card? Understanding the difference between a personal loan

How a Personal Loan Can Ease Your Month-End Cash Crunch

Introduction You plan your monthly budget carefully. Rent is paid, EMIs are scheduled, groceries are stocked. But somehow, during the last week of the month, your bank balance starts shrinking faster than expected. A medical bill, an unexpected repair, or a delayed salary credit can create sudden stress. This situation is commonly known as a

The Rise of Micro-Investing: Why Digital Gold Is Gaining Momentum

Introduction Investing isn’t just for the wealthy anymore. Thanks to technology, individuals can now begin building wealth with micro-investing, investing small amounts regularly into assets that grow over time. One asset that perfectly aligns with this trend is digital gold. With low entry points, high liquidity, and an online process, digital gold micro-investing is becoming

How Often Should You Check Your Credit Score?

Introduction Most people check their bank balance frequently, but how often do you check your credit score? Your credit score plays a major role in loan approvals, interest rates, and even financial opportunities. Yet many individuals only check it when applying for a loan, which can be a costly mistake. If you’re planning to improve

How to Get Personal Loan Approval with a Low Salary

Introduction Earning a modest salary does not mean you cannot access credit. Many borrowers assume that low income automatically leads to rejection, but that is not always true. With proper planning and awareness, personal loan approval is possible even if your salary is on the lower side. In this guide, we’ll break down how salary

How to Get Instant Personal Loan Without Documents

Introduction In today’s digital-first India, getting access to credit is faster than ever. But many borrowers still worry about lengthy paperwork, salary slips, and physical verification. That’s where the idea of an instant personal loan without documents becomes appealing especially for those who prefer to get instant loans online with minimal hassle. Whether you’re self-employed,

Valentine’s Day 2026: Smart Gift Ideas That Fit Your Budget

Introduction Valentine’s Day 2026 is around the corner, and with it comes the pressure to find the perfect gift. But here’s the truth: love isn’t measured by price tags. Whether you’re planning something romantic, practical, or memorable, smart gifting is about thoughtfulness, not overspending. If you’re working within a budget, don’t worry. There are plenty

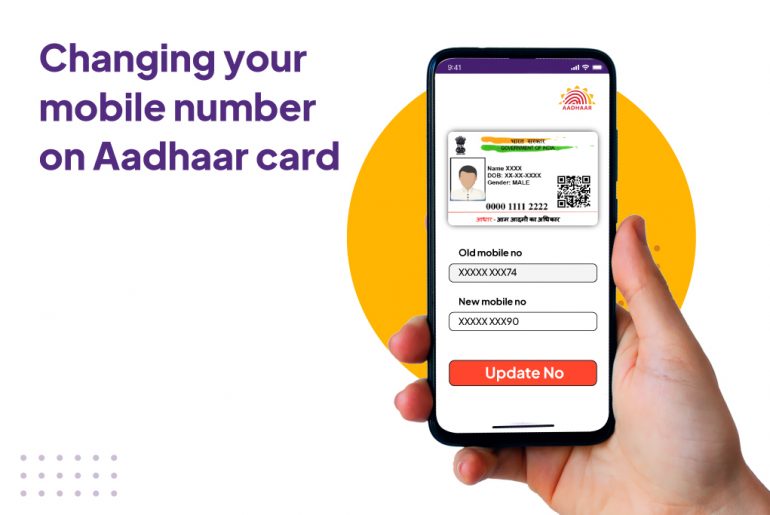

How to Update Aadhaar Address Online Step by Step

Introduction Your Aadhaar card is one of the most important identity documents in India. Whether you move to a new city, shift houses, or change your surname after marriage, keeping your Aadhaar details updated is essential. If you’re wondering how to update your Aadhaar address online, this guide walks you through everything in a simple

How to Check Driving Licence Status Online

Introduction Applied for a driving licence and wondering what’s happening next? Whether you’ve applied for a new licence, renewal, duplicate copy, or correction, knowing how to check driving licence status online can save you time and unnecessary visits to the RTO. In 2026, the government has made it easier than ever to track your driving

How to Check PAN Card Status Online Without Hassle

Introduction Applying for a PAN card is often the first step towards managing taxes, investments, and financial services in India. After submitting an application, the next natural question is how to check PAN card status online, without confusion or repeated follow-ups. Thankfully, the process is simple, digital, and can be done from anywhere in minutes.

How to Renew Driving Licence Online 2026

Introduction A driving licence is not just a legal document, it is proof that you are authorised to drive on Indian roads. However, licences come with an expiry date, and timely renewal is essential. If you’re wondering how to renew a driving licence online, the process in 2026 is simpler than ever thanks to digital

How to File GST Returns Online: Step-by-Step Process for Taxpayers

Introduction Filing GST returns is a key responsibility for registered taxpayers in India. Whether you are a small business owner, freelancer, or growing enterprise, understanding how to file GST returns online helps you stay compliant, avoid penalties, and maintain smooth business operations. With the process now fully digital, GST return filing is simpler, provided you

How to Borrow Responsibly in India: A Complete Guide

Introduction Borrowing money is not inherently bad. In fact, when done wisely, it can help you manage emergencies, invest in opportunities, and achieve financial milestones. However, understanding how to borrow responsibly is crucial, especially in today’s digital-first environment where access to a personal loan or even an instant personal loan is just a few clicks

How to Download Masked Aadhaar Card Online in India

Introduction With rising awareness around data privacy and identity theft, protecting personal information has become essential. Aadhaar is widely used for verification across services, but sharing the full Aadhaar number everywhere can increase the risk of misuse. This is where a masked Aadhaar download becomes useful, allowing you to verify identity while keeping sensitive details

How to Get a Personal Loan: A Simple Step-by-Step Guide

Introduction Whether you’re dealing with an emergency, planning a major expense, or simply need short-term financial support, knowing how to get a personal loan can make the process far less stressful. With digital platforms and online lenders, applying for a loan today is quicker and more transparent than ever. This guide explains everything you need

Personal Loan for Anniversary: Celebrate Without Financial Stress

Introduction Anniversaries are milestones worth celebrating, whether it’s a quiet dinner, a surprise getaway, or renewing vows with loved ones. But meaningful celebrations often come with unexpected expenses. Instead of letting costs overshadow the joy, a personal loan for anniversary celebrations can help you plan something special while keeping your finances balanced. You can even

Personal Loan for Electronic Appliances: Smart Gadget Upgrade

Introduction From smartphones and laptops to smart TVs and washing machines, electronic appliances have become essential to modern living. However, with rapid technology upgrades and rising costs, replacing or upgrading gadgets often strains monthly budgets. A personal loan for electronic appliances offers a practical way to make smart upgrades without delaying your needs or disturbing

Top Personal Loan Apps 2026 in India

Introduction Personal loan apps have transformed how Indians borrow money. What once took days of paperwork and branch visits can now be done in minutes from a smartphone. In 2026, top personal loan apps are faster, more transparent, and more tailored to individual credit profiles, making short-term borrowing simpler for salaried professionals, gig workers, and

Personal Loan for Education: Faster Alternative to Study Loans

Introduction Education is one of the most valuable investments you can make, but it often comes with immediate costs. From course fees and exam registrations to devices, accommodation, or last-minute expenses, not all education-related needs fit neatly into traditional education loans. This is where a personal loan for education can act as a faster, more

Personal Loan for Marriage: Smart Ways to Fund Wedding Expenses

Introduction Weddings in India are joyous celebrations, but they often come with significant expenses, from venue bookings and catering to jewellery, outfits, and travel. While savings play an important role, not everyone wants to exhaust years of hard-earned money at once. This is where a personal loan for marriage in India can help manage wedding

Personal Loan for Home Renovation: Complete Guide for 2026

Introduction Home renovation is no longer just about aesthetics, it’s about comfort, functionality, and future value. Whether you’re upgrading your kitchen, fixing plumbing issues, or giving your home a long-overdue makeover, costs can add up quickly. In 2026, many homeowners are choosing a personal loan for home renovation as a flexible and faster way to

Top 6 Reasons for Rejection of Your Personal Loan

Intro: When a Loan Rejection Feels Like a Dead End Getting a personal loan rejection can be frustrating, especially when you’re counting on that money for something important. The good news? Most rejections happen due to a few common, fixable reasons. Understanding why a personal loan gets rejected is the first step towards improving your

Unexpected Costs? Here’s How a Personal Loan Can Save You

Introduction Unexpected expenses have a way of arriving when we least expect them, medical bills, urgent repairs, sudden travel, or delayed salaries. When savings are not enough or you don’t want to disrupt long-term financial plans, a personal loan can act as a practical safety net. Used responsibly, it helps you manage emergencies without adding

World Cancer Day: When Cancer Turns Your World Upside Down

Introduction Cancer rarely arrives with a warning. One diagnosis can instantly change daily routines, family dynamics, finances, and emotional well-being. On World Cancer Day, the focus goes beyond statistics, it is about understanding how cancer impacts real lives and why awareness, preparedness, and timely action matter more than ever. Why World Cancer Day Matters Today

Union Budget Explained for Beginners: A Simple Guide for Everyone

Introduction — What Is the Union Budget? If you’ve ever wondered what exactly the Union Budget is and why it makes headlines every year, you’re not alone. In simple terms, the Union Budget meaning refers to the government’s annual financial plan. It outlines how the country plans to earn money and how it intends to

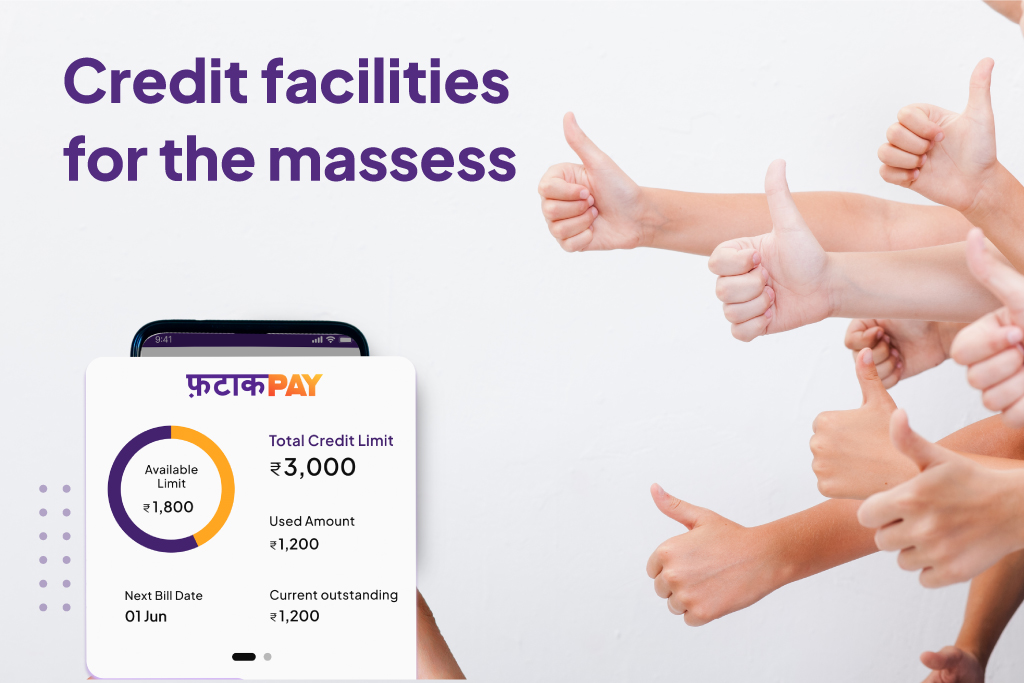

From Loans to Investments: What You Get with FatakPay

Introduction: One App, Multiple Financial Needs Managing money today shouldn’t mean juggling five different apps for loans, credit checks, insurance, and investments. That’s exactly the gap FatakPay aims to bridge. Designed as an all-in-one financial wellness platform, the FatakPay app brings borrowing, protection, and wealth-building together, making money management simpler, faster, and more accessible. What

Union Budget 2026–27: What the Financial Sector & Banking Can Expect

Introduction The Union Budget 2026–27 will arrive at a critical moment for India’s economy. With growth stabilising, inflation moderating, and digital adoption accelerating, expectations from the banking sector and the broader financial sector are higher than ever. Policymakers are likely to focus on strengthening financial resilience while supporting innovation, inclusion, and long-term capital formation. This

How to Get ₹5 Lakh Personal Loan in India: Eligibility, Documents & Tips

A ₹5 lakh personal loan is often the right solution when you need a larger sum without pledging any collateral. Whether it’s for medical expenses, home renovation, education, wedding costs, or consolidating existing debt, this loan amount offers flexibility with structured repayment. In this guide, we explain how to get a ₹5 lakh personal loan

Why Instant Personal Loans Are Gaining Popularity in India in 2026

Borrowing in India has evolved rapidly over the last decade. Long queues, paperwork, and delayed approvals are being replaced by fast, digital-first solutions. In 2026, instant personal loans are no longer a niche offering, they are becoming a preferred choice for millions of borrowers across the country. This growing shift reflects changing lifestyles, urgent financial

Common Myths vs Facts About Cancer Insurance in India

Cancer is no longer a rare or distant health concern. Yet, despite rising awareness, many people in India hesitate to buy cancer insurance because of widespread myths and misconceptions. These misunderstandings often prevent individuals and families from securing timely financial protection. This blog separates myths vs facts around cancer insurance, helping you make informed decisions

Republic Day 2026: Rights, Responsibilities, and Smart Financial Choices

Republic Day 2026 is not just a national holiday marked by parades and patriotic songs. It is a reminder of the values enshrined in the Constitution, equality, responsibility, and empowerment. While we often reflect on our rights as citizens, Republic Day is also a powerful moment to think about how our everyday choices shape our

Should You Invest in Digital Silver or Physical Silver in 2026?

Introduction Silver has long been valued in India, not just as a precious metal, but as a store of value and a versatile industrial asset. As we step into 2026, investors are increasingly asking a key question: should you invest in digital silver or physical silver? With technology transforming how we buy and hold assets,

5 Reasons Why Personal Accident Insurance Is Essential for Working Indians

For most working Indians, financial planning often focuses on savings, investments, and health insurance. However, one crucial aspect that is frequently overlooked is protection against accidents. With increasing road traffic, workplace hazards, and daily commuting risks, accidents can strike without warning, often leading to sudden financial strain. This is where personal accident insurance becomes an

How to Get a Personal Loan Without a CIBIL Score in India

Introduction For many first-time borrowers, gig workers, or individuals new to formal credit, not having a credit history can feel like a dead end. A common question people ask is whether it’s possible to get a personal loan without a CIBIL score in India. The good news? Not having a CIBIL score does not mean

Best Options for a ₹50,000 Personal Loan in India

A small financial gap doesn’t always require a large loan. For many individuals, a ₹50,000 personal loan is the ideal solution to handle urgent expenses without long-term financial pressure. From medical needs to short-term cash flow issues, this loan amount offers quick relief with manageable EMIs. In this guide, we break down the best options

Digital Silver Price: What Is & What Will Be? (5 Jan 2026 – 11 Jan 2026)

Introduction Silver prices showed resilient performance in the second week of January 2026 as markets stabilized following the holiday period. The digital silver price in India demonstrated firmness, supported by renewed trading activity, industrial demand expectations, and strategic buying from investors seeking diversification alongside gold. After a short consolidation phase in early January, silver prices

How to Get a Personal Loan at Lowest Interest Rate in India

Introduction: Why Personal Loan Interest Rates Matter When you take a personal loan, getting a loan at lowest interest rate plays a crucial role in how affordable it truly is. Even a small difference in rates can significantly impact your monthly EMI and the total amount you repay over time. That’s why understanding how personal

Top 6 Financial Lessons From Makar Sankranti

Makar Sankranti marks a powerful transition, the sun’s movement into Capricorn and the beginning of longer, brighter days. Across India, the festival is celebrated with kites, harvest rituals, and a renewed sense of optimism. Beyond its cultural significance, Makar Sankranti also offers timeless wisdom that applies beautifully to personal finance. From setting direction to staying

Start Small, Grow Big: Business Ideas for Women from Home

Starting a business no longer requires a large office, heavy investment, or years of experience. Today, more women are choosing to build successful ventures from the comfort of their homes, balancing family responsibilities while creating financial independence. With the right idea, planning, and support, even a small beginning can grow into a sustainable income source.

Digital Silver Price This Week (12th–18th January 2026)

Here’s how the digital silver price per 10 grams, 100 grams, and 1 kilogram moved during last week: Date 10g 100g 1Kg Change vs Previous Day 18 Jan 2026 ₹2,950 ₹29,500 ₹2,95,000 0 17 Jan 2026 ₹2,950 ₹29,500 ₹2,95,000 +₹3,000 16 Jan 2026 ₹2,920 ₹29,200 ₹2,92,000 -₹3,000 15 Jan 2026 ₹2,950 ₹29,500 ₹2,95,000 +₹5,000 14

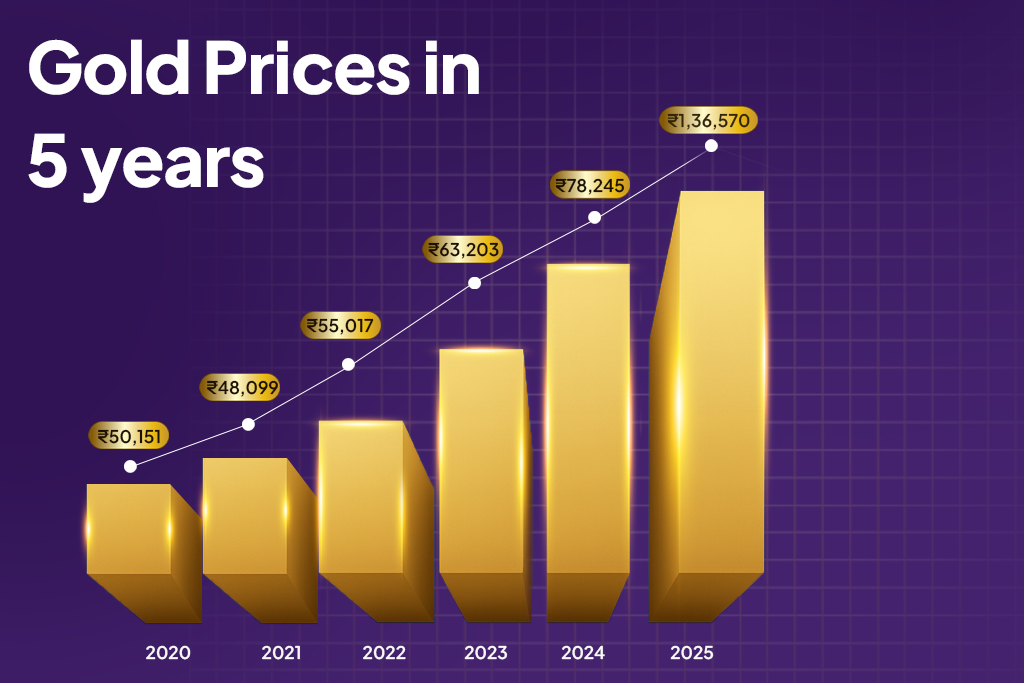

Digital Gold Trends: Gold Prices in 5 Years

Digital gold has steadily become a preferred investment option for millions of Indians, thanks to its simplicity, transparency, and low entry barrier. Whether you’re a new investor or someone looking to diversify, understanding how gold prices in 5 years have moved is essential to making informed decisions. The last five years have been particularly eventful

Accidental Insurance for Gig Workers: Ensuring Safety, Security, and Financial Stability

Accidental insurance for gig workers has become essential as India’s gig economy continues to grow rapidly, powered by delivery partners, ride-hailing drivers, warehouse associates, freelancers, and platform-based workers. While this flexible work model offers earnings and independence, many still lack structured financial protection, especially against accidental risks. In such a high-mobility, physically demanding environment, accidental

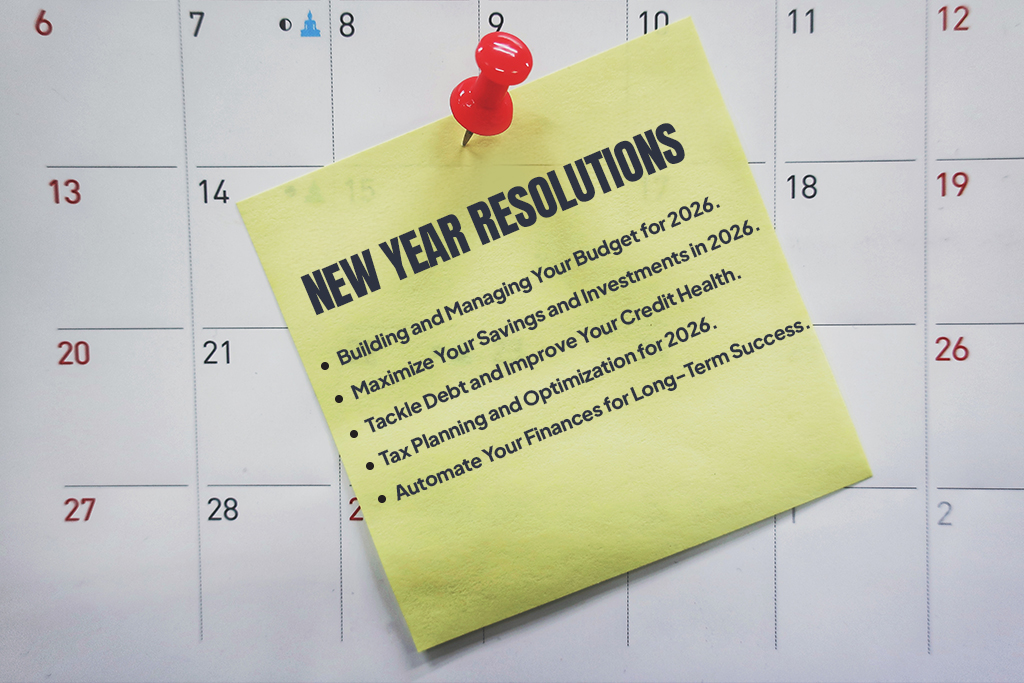

New Year’s Resolutions 2026: Smart Financial Goals for a Better Future

New Year’s resolutions give you the perfect chance to reset, rethink, and realign your finances. Whether 2025 brought growth, challenges, or important lessons, 2026 offers a clean slate to make smarter money decisions. Setting New Year financial goals isn’t about drastic changes it’s about consistent, realistic steps that strengthen your long-term financial health. These financial

Your Year-End Financial Checklist: Preparing for a Prosperous New Year

As the year draws to a close, it’s the perfect time to pause, review, and realign your finances. A thoughtful year-end financial checklist not only helps you close the current year on a strong note but also sets the foundation for smarter decisions in the year ahead. Whether your focus is saving more, reducing debt,

All I Want This Christmas Is… Financial Wellness

The Season of Joy… and Overspending Christmas financial wellness is about enjoying the season of celebration without the burden of stress and overspending. Christmas brings twinkling lights, gift exchanges, festive meals, and joyful gatherings with loved ones but it can also bring pressure to spend more, buy bigger gifts, and celebrate harder. Before we realise

Digital Gold Investment: Lumpsum vs SIP Which Is Better for You?

Lumpsum vs SIP: Digital gold has made investing in gold simpler, safer, and more accessible than ever. Whether you are a first-time investor or someone looking to diversify your portfolio, digital gold offers the flexibility to invest either as a one-time lumpsum amount or in small, regular SIP installments. But a common question many investors

Top 7 Practical Uses of Gold You Probably Didn’t Know About

Uses of gold go far beyond jewellery, wealth, or festive investments. While most people instantly associate gold with ornaments and financial value, it is far more than just a shiny precious metal. Its unique properties such as high conductivity, corrosion resistance, and biocompatibility make it one of the most versatile materials used across various industries.

Digital Gold vs Physical Gold: Which Is Better for You?

Same Sona, New Options Digital gold vs physical gold is a common comparison for Indian investors looking for long-term financial security. Gold has always been a symbol of wealth and safety in India. Traditionally, families invested in physical gold such as jewellery, coins, biscuits, and bars. However, in recent years, a modern alternative has emerged

Advantages and Disadvantages of Digital Gold Investments

Introduction Understanding the advantages and disadvantages of digital gold is important before investing in this modern form of gold. Digital gold has quickly become one of India’s most popular investment options, offering simplicity, accessibility, and transparency. Unlike traditional physical gold, it allows investors to buy small quantities online, track real-time prices in real time, and

What Is a Credit Score? A Simple Guide for Every Borrower

When you apply for a loan, credit card, or even an EMI plan, lenders often look at one number before making a decision and that’s your credit score. This three-digit figure tells banks how trustworthy you are as a borrower. Yet, many people still wonder: What is a credit score, how is it calculated, and

Digital Gold Returns: How ₹10,000 Grew in the Last 5 Years

Digital gold returns have attracted growing attention as gold continues to be one of India’s most trusted wealth-building assets. With market volatility, inflation, and global uncertainty increasing over the years, many investors now look for options that offer both stability and long-term growth. This is where digital gold investment has gained massive popularity, allowing anyone

What Is Digital Gold & Why It’s a Smart Investment Today

What is digital gold? It is a modern way of investing in gold that combines the trust of a centuries-old asset with the convenience of technology. In India, gold has traditionally been bought as jewellery, coins, or bars. Today, digital gold allows investors to own gold online without physical storage hassles. This article explains what

What is FatakUdaan: Improve Your Credit Score Today

In today’s digital economy, your credit score is more than just a number, it’s your financial identity. Whether you’re applying for a personal loan, a credit card, or even a rental agreement, that three-digit score determines how easily you can access credit. But what if you have no credit history or a low credit score?

Is Digital Silver a Good Investment in 2026?

Silver has long been considered a safe-haven investment, offering a stable and tangible way to diversify one’s portfolio. With the rise of digital assets, investing in silver has become even more convenient. Digital silver allows you to buy, sell, and hold silver online without worrying about storage or purity issues. But is digital silver a

Introducing FatakUdaan – Build, Improve & Unlock Your Credit Potential

What is FatakUdaan? Improve your credit score especially if you’ve ever been denied a loan or credit card due to a low or non-existent one. Many first-time borrowers and gig workers in India struggle to access formal credit, not because they can’t repay, but because they haven’t had the opportunity to build a credit report.

Top Benefits of Investing in Digital Gold

Investing in digital gold has become increasingly popular as India’s investment habits evolve. While gold has long been one of the country’s most trusted and traditional assets, rising digital adoption and modern lifestyles have transformed how people choose to invest in it today. Digital gold has emerged as a smart, convenient, and secure option for

Best Ways to Save Money: 10 Practical Budgeting Tips for Everyone

Saving money is not about earning more, it’s about managing what you already have. Whether you’re a student, working professional, gig worker, or running a household, effective budgeting gives you clarity, control, and confidence over your finances. If you’re looking for the best ways to save money, these budgeting strategies will help you cut unnecessary

Digital Gold Price Weekly Report: (9th Feb 2026 – 15th Jan 2026)

Introduction Gold prices in India continued to command elevated levels in the second week of February, supported by safe-haven demand and renewed volatility in global markets. The digital gold price, closely aligned with physical 24K gold spot rates, maintained an upward bias during the week, reflecting strong investor interest even as profit-taking surfaced on sporadic

Instant Personal Loan for Moving to a New City: A Complete Guide

Moving to a new city is an exciting chapter, whether it’s for a better job, education, career shift, or simply a fresh start. But relocation comes with multiple hidden and often unexpected costs. From housing deposits to travel, movers, and settling-in expenses, the financial pressure can increase quickly. This is why many people choose an

How a Personal Loan for Wedding Can Simplify Your Big Day Budget

A personal loan for wedding can help families manage the rising costs of celebrations without stress. A wedding is one of the most cherished milestones in India—a beautiful blend of family, culture, and togetherness. But behind the joy lies one of the biggest financial commitments many families make. With increasing expenses and growing expectations, planning

How to Start Investing in Digital Gold: Step-by-Step for Beginners

Start investing in digital gold online and you no longer need to buy bulky coins, jewellery, or bars to begin your gold journey. Gold has always been one of India’s most trusted investment choices, and now you can buy pure, insured 24K gold instantly from as little as ₹10—making gold investing simpler, safer, and accessible

Personal Loan for Gig Workers: Simple Income Proof Guide

Understanding Personal Loans for Gig Workers Personal loan for gig workers has become increasingly important as gig work such as freelancing, delivery services, content creation, and ride-hailing continues to grow as a mainstream livelihood. Yet, many gig workers still face challenges in securing loans because they don’t have traditional salary slips or fixed employment contracts,

Is an Instant Personal Loan the Best Way to Finance Your First Bike?

A personal loan for two wheeler purchases can make owning your first bike much easier. Whether it’s for your daily commute, weekend rides, or the freedom of having your own vehicle, buying a bike is a major milestone. But saving for months or paying a large upfront amount isn’t always practical. That’s why many first-time

Pradhan Mantri Marriage Loan: Full Details, Eligibility and Benefits

Weddings in India are grand, emotional and often expensive. From venue bookings and jewellery to catering and photography, costs can quickly add up, leaving many families searching for affordable financing options. This is where the term Pradhan Mantri Marriage Loan has recently gained popularity. But is there really a government-backed marriage loan? What does it

5 Questions to Ask Before You Take Out an Instant Personal Loan Online

Instant digital borrowing has changed the way India manages money. Today, whether it’s a medical emergency, home repair, travel plan, or month-end cash crunch, many people choose an instant personal loan online because it’s quick, paperless, and available within minutes. But speed should never replace smart decision-making. Before you get instant personal loan approval, it’s

Benefits of Using a Personal Loan to Buy a Laptop

A personal loan to buy a laptop can make your purchase easier because a laptop is no longer a luxury it is a necessity. Whether you’re a student attending classes online, a working professional, a freelancer, or someone building a side hustle, a laptop plays a major role in productivity and skill growth. However, good-quality

Digital Gold SIP: Monthly vs Weekly Which One Works Better?

Digital gold has become one of India’s most trusted and convenient investment options, especially for beginners who want to start small. With the flexibility of digital gold SIP, users can buy gold in tiny amounts like daily, weekly, or monthly, without worrying about purity, storage, or safety. Monthly SIPs are simple, predictable, and ideal for

Why Instant Personal Loans Are a Game-Changer for Freelancers

Instant personal loans can be a lifeline as freelancing in India grows rapidly, with designers, writers, gig workers, creators, consultants, and tech experts facing unpredictable income cycles. This is where instant loans online have transformed the game. Designed for speed, convenience, and flexibility, they offer freelancers the financial support they often can’t get from banks.

How to Use Personal Loan for Purchasing a Car

Personal loan for car are becoming a popular choice among buyers because owning a vehicle is a major milestone whether it’s for daily commutes, family convenience, or personal comfort. While many still consider traditional car loans, more smart buyers are shifting to personal loans for the flexibility, quicker approvals, and fewer restrictions they offer. This

Using an Instant Personal Loan to Fund a Business Startup

Starting a business is exciting, but it also demands money. Whether you’re launching a home-based venture, offering freelance services, or building a small digital business, you’ll need funds for setup, tools, marketing, and operations. While traditional lenders often require heavy documentation, credit history, or collateral, instant loans online have become a practical, accessible solution for

Using an Instant Personal Loan for Medical Emergencies: A Lifesaver

A personal loan for medical emergencies can be a lifesaver because a medical crisis can happen without warning, and when it does, the financial pressure often arrives before the medical bills themselves. Whether it’s hospitalisation, urgent medication, diagnostic tests, or immediate treatment, the costs can escalate quickly. This is why having access to an instant

How to Use an Instant Personal Loan for Education Expenses

An instant personal loan for education can be a lifesaver because education is one of the most valuable investments you can make, but it often comes with sudden or unplanned expenses. From exam fees and online courses to skill certifications and laptops, the cost of upgrading your education can quickly add up. This is where

Factors Affecting Your Personal Loan Interest Rates

A personal loan is one of the most convenient ways to manage expenses, emergencies, or planned financial goals. But the final cost of your loan depends greatly on one thing, your personal loan interest rate. Understanding what influences this rate can help you make smarter financial decisions, reduce your borrowing costs, and unlock better loan

How to Refinance Your Personal Loan for Better Terms

A personal loan can be a helpful way to manage major expenses, but as time passes, your financial situation, credit score, or income levels may change. When that happens, you might find that your current loan terms no longer suit your goals. This is where personal loan refinancing comes in, a smart strategy that allows

Personal Loan vs Instant Loan: Which One is Right for You?

Introduction Whether it’s funding a home renovation, covering an emergency, or fulfilling a long-awaited dream, borrowing can be a practical way to meet financial goals. However, choosing between a personal loan and an instant loan can be confusing for many borrowers. Both serve different financial needs and come with unique benefits. Let’s understand how they

How Small Loans Create Big Credit Impact

Small Loans, Big Impact When people think of improving their financial health, they often imagine large loans or complex investments. But in reality, small instant loans can be one of the smartest ways to build a strong credit foundation. By responsibly borrowing and repaying micro loans, individuals can create a lasting credit footprint, proving reliability,

6 Steps to Reach a 750+ Credit Score

Your credit score is the foundation of your financial health. A reflection of how responsibly you manage money. Whether you’re applying for a credit card, personal loan, or unsecured loan, a score of 750 or above is the golden number that lenders look for. A higher score means better loan approvals, lower interest rates, and

Top 5 Factors That Affect Your Credit Score

Why Credit Score Matters More Than You Think Your credit score is more than a number, it’s your financial reputation. Whether you’re applying for an instant personal loan online, a credit card, or a home loan, this score helps lenders determine how trustworthy you are as a borrower. A good score opens the door to

Why Your Credit Score Decides Your Loan Fate

Have you ever wondered why some people get instant personal loan approval while others wait weeks or face rejection? The answer lies in one crucial number and that’s your credit score. This three-digit number summarises your borrowing behaviour, repayment discipline, and overall financial reliability. For lenders, it’s the first and most important signal of whether

How to Check, Improve, and Understand Your CIBIL Score: A Complete Guide

Introduction Your CIBIL score is more than just a number, it’s your financial fingerprint. Whether you’re applying for a personal loan, credit card, or mortgage, this score plays a crucial role in determining your creditworthiness. Many borrowers, especially first-timers, often wonder what a good CIBIL score is, how it’s calculated, and how they can improve

5 Reasons You Should Consider Cancer Insurance This Cancer Awareness Day

Every year, National Cancer Awareness Day is observed on 7th November in India to spread awareness about early detection, prevention, and treatment of cancer. While awareness about lifestyle changes and screening has grown, one crucial aspect still gets overlooked & that is financial preparedness. A cancer diagnosis not only impacts physical and emotional health but

CIBIL Score Explained: What It Is and How It Affects Your Loan Approvals

What is a CIBIL Score? A CIBIL score is a three-digit number that reflects your creditworthiness or simply put, how reliable you are when it comes to repaying loans and credit card dues. It ranges between 300 and 900, with higher scores indicating better financial discipline. Lenders use your CIBIL score to decide whether to

Credit Score Myths vs Facts: What You Really Need to Know

Your credit score is one of the most important numbers in your financial life as it determines whether you get a loan how much interest you’ll pay and even your overall creditworthiness. But thanks to misinformation and half-truths many borrowers still misunderstand how it works. From believing that checking your score lowers it to thinking

Factors That Drive Your Credit Score in 2025

Your credit score plays a key role in your financial journey, it’s the number that lenders trust before offering you a loan or credit card. In 2025, with digital lending growing rapidly, understanding the factors that drive your score can help you make smarter borrowing decisions. Let’s break it down: Why lenders check credit score

Credit Score 101: Everything You Must Know

When it comes to borrowing money, your credit score plays a key role in deciding whether you get approved for a loan and at what interest rate. Many people are aware of the term but often confused about its actual meaning, importance, and impact on their financial health. This guide covers everything you must know

Travel Now, Pay Later: Using Personal Loans for Dream Vacations

A dream vacation doesn’t have to wait for your savings to catch up. Whether it’s a solo getaway, a family trip, or a long-planned international adventure, a personal loan to travel can make it happen without the stress of depleting your savings. With instant personal loan apps like FatakPay, travellers can now fund their journeys

How Personal Loans Help Women Build Credit Scores & Financial Independence

In today’s world, financial independence is more than just earning, it’s about having access to credit, managing responsibilities, and building long-term security. For women, an instant personal loan can be more than a source of funds, it can also be a stepping stone to a stronger financial future and a better credit score. With the

How to Choose the Right Insurance Plan for Your Needs

Finding the best health cover for family members can feel overwhelming, especially with so many insurance options and jargon. But with the right guidance, you can make an informed decision, the one that protects what matters most: your loved ones and future. Below, we break down the main types of insurance plans, highlighting the five

What is eNACH? Everything You Need to Know About Auto-Debits

Managing multiple payments like EMIs, SIPs, or monthly bills – can often feel overwhelming. This is where eNACH (Electronic National Automated Clearing House) steps in as a secure and seamless way to automate recurring payments. Let’s break down what eNACH is, how it works, and why it’s becoming the preferred choice for millions of users.

Personal Loans During Festivals: Managing Big Purchases the Smart Way

What is a personal loan? A personal loan is an unsecured loan that allows you to borrow money without pledging any collateral. It’s flexible, can be used for multiple purposes, and is especially useful during festive seasons when big purchases and unplanned expenses can add up quickly. Why is financial planning needed for festive spendings?

Personal Loans for Salaried Professionals

Managing money as a salaried professional can be challenging, especially when you’re just starting out. Here are some practical tips for young salaried professionals: How to get a personal loan Today, getting a salaried personal loan is easier than ever. Here are the common routes: Banks vs Digital Personal Apps for Instant Loans Feature Banks

5 Benefits of Personal Loan for Women in India

Women in India today are balancing careers, households, and personal ambitions. Whether it’s for professional growth, personal needs, or unforeseen expenses, having access to credit is crucial. A personal emergency loan offers flexibility, helping women manage finances smartly without having to dip into long-term savings or investments. Funding Education Higher education, whether in India or

Personal Loans for Solo Travellers: Empowering Women to Explore the World

Travelling solo is a dream for many women. It’s liberating, confidence-building, and often a once-in-a-lifetime experience. But financial constraints can make that dream harder to realise. With the right financial tools, however, solo travel is no longer out of reach. One of the most effective solutions is opting for an instant personal loan, a smart

Benefits of FatakPay’s Kavach Accident Insurance

Accidents don’t knock before arriving, and their impact can be both emotional and financial. While we can’t control when or where an accident might occur, we can certainly prepare for the consequences. FatakPay’s Kavach Accidental Insurance, offered under FatakPay insurance solutions, is designed to give you and your family a financial shield against life’s unexpected

What is FatakSecure?

At FatakPay, we believe insurance should be empowering, accessible, and genuinely protective. That’s why we created FatakSecure, a suite of affordable, digital-first insurance policies tailored to everyday needs. Whether you’re looking for 1-year health insurance, protection against life’s unexpected medical costs, or specialised cover for critical situations, FatakSecure has you covered. Insurance Policies by FatakPay:

Benefits of FatakSecure’s Cancer Insurance

Cancer Insurance: What is Cancer Insurance? Cancer insurance offers a financial lifeline by providing a lump-sum when you are diagnosed with cancer. Unlike standard health insurance, which often only covers hospitalisation, cancer insurance is tailored to meet the costs of treatments such as chemotherapy, surgery, follow-ups, and associated care. It is one of the most

This Bhai Dooj, Empower Your Sister with Thoughtful Financial Gifts

The Festival of Sibling Bonds Bhai Dooj is a celebration of the sacred bond between brothers and sisters, it’s a day of love, blessings, and gratitude. Traditionally, brothers promise to protect their sisters and offer gifts as a symbol of care. But in today’s world, true protection goes beyond material presents, it lies in securing

Keep The Sona Lose The Papdi: Digital Gold vs. Soan Papdi

Every Diwali a familiar relay race begins. A maroon-gold box arrives, you smile politely, and before the diyas cool you pass it to the next unsuspecting relative. Congratulations, you’ve participated in India’s biggest circular economy: Soan Papdi. Meanwhile, the wealth you wished each other in the WhatsApp greeting remains theoretical. This year, retire the re-gift

Why Digital Gold is the Shining Investment Choice This Diwali

Diwali, the festival of lights, is synonymous with prosperity, wealth, and the timeless tradition of buying gold. But while physical gold remains a symbol of fortune, modern investors are turning to a smarter, more accessible alternative—digital gold investment. With no worries about storage, purity, or hefty upfront costs, digital gold has emerged as a practical

Secure Your Future: Financial Lessons from Dhanteras

Dhanteras marks the beginning of Diwali, a day dedicated to wealth, prosperity, and new beginnings. Traditionally, people purchase gold, silver, or valuable assets to invite good fortune. But beyond the rituals, Dhanteras also teaches us powerful financial lessons about financial planning and building long-term wealth. In today’s digital world, that spirit of prosperity translates into

Burning the Ravanas of Debt: Financial Lessons for a Secure Future

Dussehra is celebrated across India as the triumph of good over evil, with Lord Rama’s victory over Ravana symbolising the power of discipline, courage, and wisdom. But beyond its mythological importance, this festival also carries lessons we can apply in our day-to-day lives, especially when it comes to financial planning. Just as Ravana’s ten heads

Blue Collar Worker Trend in Digital Gold Investing | July 2025

What is FatakPay? FatakPay is more than just a digital lending platform. It’s a financial wellness app designed for India’s blue-collar and gig workforce. With features that go beyond instant salary access, FatakPay allows users to start investing in digital gold and silver for as little as ₹10. This accessibility is transforming how workers traditionally

What is credit score and why it matters?

In today’s digital financial landscape, a credit score acts like your financial passport, determining whether lenders trust you with a loan, credit card, or housing. This three-digit number, generated by credit bureaus, reflects your repayment behaviour, debt levels, and financial reliability. It’s essential to understand what this score really signifies and why it plays such

10 ways to improve Credit Score

In today’s financial landscape, your credit score is like your financial report card. Whether you’re applying for a personal loan, a new credit card, or even a rental property, lenders and service providers often assess your creditworthiness through this number. But what if your score isn’t great? Don’t worry! Improving your credit score is absolutely

What is accidental Insurance and why you should have one?

Introduction In a country as vast and diverse as India, life moves fast and often on roads where safety takes a backseat. Be it someone riding a two-wheeler without a helmet, a delivery partner navigating traffic under pressure, or a construction worker climbing a scaffold, accidents don’t ask before they strike. Despite this, most people,

Gold vs. Silver Price Trend (2015-2025) | How to invest in digital gold?

How to Invest in Digital Gold? Over the last decade, gold and silver have remained popular choices for investors looking to diversify and hedge against economic uncertainty. Both metals offer unique benefits and are influenced by distinct market forces. Let’s analyse how prices have evolved and understand which metal might be better suited for your

Mistakes to avoid as a new investor

Entering the world of investing can be exciting but also overwhelming. With so many platforms, opinions, and options available today, especially for those looking to invest online, it’s easy to get carried away or make hasty decisions. However, with the right guidance and awareness, beginners can build a strong foundation for long-term financial growth. Let’s

Simplifying gold investment online

For centuries, gold has been a symbol of wealth, security, and stability. Today, with just a few taps on your smartphone, you can begin your journey into gold investment without visiting a jeweller or worrying about storing physical gold. Digital gold investing offers a modern, convenient, and transparent way to buy, hold, and even sell

Digital Investing: Digital Gold vs. Mutual Funds

In 2025, salaried professionals continue to rely on personal loans as a flexible financial tool, whether for medical emergencies, debt consolidation, weddings, or home renovations. But with multiple apps and financial institutions offering instant loans for salaried individuals, it’s important to know how to navigate your options wisely just like understanding how to invest wisely

Personal loan tips for salaried professionals in 2025

In 2025, salaried professionals continue to rely on personal loans as a flexible financial tool, whether for medical emergencies, debt consolidation, weddings, or home renovations. But with multiple apps and financial institutions offering instant loan for salaried individuals, it’s important to know how to navigate your options wisely. A well-informed decision can help you manage

What are the benefits for digital gold investment?

Gold has long been regarded as one of the safest forms of investment, especially in uncertain economic times. But in today’s digital world, you no longer need to visit a jeweller or bank to invest in this precious metal. Digital gold offers a secure, convenient, and modern alternative that lets you buy, sell, and store

What is advance salary loan and how does it help?

In a world where financial needs can be unpredictable, a salary advance loan can be a real blessing. Whether it’s for an unexpected medical bill, a sudden travel expense, or to tide you over until your next payday, a fast loan advance provides quick access to funds based on your earned salary. But what exactly

How to avail instant personal loan with low credit score?

A personal loan can be a financial lifesaver; whether you’re facing an emergency or simply need to bridge a short-term cash crunch. But what if your credit score isn’t ideal? Can you still apply for an instant personal loan? The answer is yes, with a few smart steps and the right lender. Let’s understand the

Common Personal Loan Scams and How to Avoid them

In a world where everything from groceries to loans is just a click away, the rise of digital lending platforms has been a game-changer. But while small loan apps and online personal loans have made credit more accessible, they’ve also opened the door for fraudsters. If you’re someone searching for immediate loans online, it’s crucial

Importance of Personal Loan Education for salaried employees

For many salaried individuals, especially those earning up to ₹35,000 a month, financial planning often revolves around managing monthly expenses, keeping up with the bills, and navigating unexpected situations. In such cases, the availability of an urgent loan can offer temporary relief but only if one understands how personal loans truly work. This is where

Prosperity with Purpose: 10 Financial Lessons from Lord Ganesha

Ganesh Chaturthi isn’t just about colourful idols and modaks, it’s an opportunity to reflect on deeper life lessons. As Lord Ganesh embodies wisdom, new beginnings, and prosperity, his stories and symbols offer valuable guidance, not just for the spirit, but for our finances too. At FatakPay, we believe finance is more than numbers, it’s the

10 Financial Wellness Learnings from the Bhagavad Gita The FatakPay Way

At FatakPay, we’ve always believed that financial well-being is more than just numbers in your account, it’s a mindset, a discipline, and sometimes, even a philosophy. And when it comes to timeless wisdom, the Bhagavad Gita has lessons that fit perfectly into today’s financial world. The Gita is more than a spiritual text; it’s a

5 Things to Know When Taking an Emergency Personal Loan

Emergencies don’t wait, and neither should you when you need funds. Whether it’s a medical situation, home repair, or a sudden travel need, an emergency personal loan can offer immediate financial help. But before you apply, it’s important to understand the key factors that affect your loan approval, interest rates, and repayment. Here are 5

How to Apply for a Personal Loan to Buy a Two-Wheeler

A two-wheeler can be a convenient and economical way to navigate everyday travel whether you’re commuting to work or exploring the open road. If you’re planning to buy a scooter or bike but don’t want to dip into your savings, a personal loan can offer the flexibility you need to fund your purchase with ease.

How to Get a Personal Loan for Your Interior Designing

Dreaming of turning your creative vision into stunning interiors, expanding your business, or taking on a bigger project? A personal loan can be the key to unlocking your plans. From sourcing premium materials to hiring skilled labour, renovating or redesigning spaces can be capital intensive. A personal loan offers a flexible, unsecured financing option to

Know the Difference: Digital Gold vs Physical Gold Investment

Gold has long been considered a reliable form of investment, offering safety during market volatility and inflation. But with the rise of fintech platforms, a new way to invest in gold has emerged: digital gold. While traditional physical gold continues to hold cultural and investment value, digital gold is gaining traction, especially among modern investors

Understanding the Importance of Personal Loan Education for Salaried Employees

For many salaried individuals, especially those earning up to ₹35,000 a month, financial planning often revolves around managing monthly expenses, keeping up with the bills, and navigating unexpected situations. In such cases, the availability of an urgent loan can offer temporary relief but only if one understands how personal loans truly work. This is where

Personal Loan for Wedding: When and How to Apply?

Planning a wedding is exciting but it also comes with a hefty price tag. From décor to catering, venues to outfits, the expenses can add up quickly. If you find yourself needing a little extra support to make your dream wedding a reality, a personal loan can be a viable option. Here’s a practical guide

How Does a Small Personal Loan Work?

Introduction When life throws an unexpected expense your way, like a medical bill, an urgent repair, or a travel emergency, a small personal loan online can be a quick and effective financial solution. These loans are designed to be simple, quick and easy to repay. Let’s understand what they are, when you should consider one,

5 Benefits of Personal Loan with FatakPay

Life is full of unexpected moments, and sometimes those moments come with unexpected costs. Whether it’s an urgent repair, a medical bill, or an exciting opportunity you don’t want to miss, a personal loan can be a lifesaver. But not all loans are created equal. Choosing the right platform can significantly impact your loan experience,

5 Things to Know When Taking an Emergency Personal Loan

Emergencies don’t wait, and neither should you when you need funds. Whether it’s a medical situation, home repair, or a sudden travel need, an emergency personal loan can offer immediate financial help. But before you apply, it’s important to understand the key factors that affect your loan approval, interest rates, and repayment. Here are 5

Why Millennials Should Choose Instant Loans and Personal Loans Today

In today’s fast-paced and financially dynamic world, millennials are embracing smarter, more flexible ways to handle money. Among these, instant personal loans and personal loans stand out as powerful tools that can help bridge gaps, unlock opportunities, and even build long-term financial credibility. Digital lending platforms like FatakPay are leading the change, making borrowing not

Government Initiatives Supporting Quick Personal Loans in 2025

When it comes to availing personal loans, apart from the private banks and NBFC-backed platforms, the government also offers different initiatives that can help you get personal loans. Some of these initiatives are popular and commonly known, whereas others are not. Moving forward with this discussion, we will enlist some of the government initiatives that

Impact of Inflation on Personal Loan Interest Rates

We are seeing a significant surge in inflation every year, not just in India but all around the globe. The rise in inflation further impacts almost everything, which includes cost of living, the financial sector, and much more. With changing inflation rates, the interest rates on personal loans also change due to the change in

RBI’s New Credit Rules & Instant Loan Eligibility

As we enter 2025, it is time to have a look at RBI’s policies and rules to make sure you are updated with their regulations. The Reserve Bank of India has introduced some new rules, which are effective from January 2025. Apart from this, there are some other rules and policies that continue to be

How Instant Loans Can Help You During an Inflation

With rising prices, society is currently experiencing a phase of inflation. This inflation has pushed us to make various changes in our lifestyles and some smart choices and decisions. During an inflationary period, it can become quite difficult to manage all your finances; however, taking out instant personal loans can help you adjust better during

How Fintech Is Transforming Personal Loan Process

Getting a personal loan is one of the most tiring and time-consuming processes one can ever go through. However, with the advanced technologies and the option of instant personal loans, this process has become quite simplified and quick. With the help of fintech institutes availing a personal loan or an instant loan online has become

How to Avoid High-Interest Payday Loans by Choosing Small Credit Options

If you have ever found yourself in any sort of financial crisis with the need of emergency funds- you know about the limited options in the market. Many people opt for Payday loans in such scenarios. However, they might not always be the right choice. Payday loans often look attractive but they are far from

How to Qualify for an Instant Online Loan with No Credit Check?

Are you looking to apply for an instant loan online but worried about your credit score? Be it a financial emergency or just a regular situation where you need funds instantly to pay the bills or go out shopping, instant personal loans online are available to help you fulfill all your financial needs. Now you

How to Protect Your Credit Score When Taking an Instant Loan Online

Introduction A lot is happening in our everyday lives, managing work, home, health, family, personal time, and finances as well. In between all this, we often miss one or two bills and miss our deadline which can reduce our credit score. Now you might think that with a low credit score your financial stability might

How to Qualify for a Loan up to Rs. 20,000 with No Collateral

Life is unpredictable, you never know when you might get stuck in an emergency and need funds instantly. Hence, it is always said to be prepared no matter what the situation is. But we all know such problems and emergencies can be faced by anyone at any time. With all the advancements in technology, we

Can an Instant Personal Loan Improve Your Credit Score? Here’s How

We all are living in a world surrounded by uncertainties. We never know when we might encounter a financial crisis or emergency. Be it travel expenses, bill payments, or something else, it is essential to be prepared for such events. To ensure we are prepared and fully equipped to handle such events, financial institutions have

Quick Tips for Managing Small Credit Loans Without Falling into Debt

We all have dreams and aspire to achieve a lot in our lives. Be it in professional, personal, or financial aspects, these aspirations never die. However, managing finances can become a dreaded task and some of us fall behind in the process of financial planning, responsibilities, and management as well. Often we fall for the

Instant Loan Online: How to Choose the Best Platform for Your Needs

We are living in a technologically advanced world where everything is available online and instantly. Be it your entertainment, shopping, or even finances, all these can be easily accessed from the comfort of your home. In the finance sector, these advanced technologies have enabled financial institutions to offer instant personal loan at the comfort of

Smart Borrowing Tips to Stay Debt-Free This Diwali

The time of festivities is back again and we all have started our preparations for Diwali. Buying clothes, sweets, and other festive items is just a part of the festival celebrations. However, we often forget about spending limits during making these festival purchases, and there is a risk of constituting debt. To avoid any such

How a Personal Loan Can Brighten Up Your Festive Celebrations

Diwali is one of the most celebrated festivals in India and the most awaited time of the year. It is regarded as an auspicious occasion to make investments or make any other new beginnings. While celebrating Diwali be it lighting up diyas or buying sweets, and gifts for loved ones, one of the major aspects

How to Apply for a Loan with Bad Credit

It is given that for a personal loan apply or any other loan, you must meet the eligibility criteria given by the lenders and the banks. This often consists of a high credit score, essential to the entire loan application process. However, for people with bad or low credit scores, this can become a problem

Is It Safe to Take a Loan Through WhatsApp Banking?

With advanced technologies and cut-throat competition every business is trying to get maximum customer attention and offering them enhanced services. For this, several financial institutions and banks are also approaching customers via WhatsApp. These WhatsApp communications are regarding availing personal loans and other financial schemes. Often such communication is right, but it is not completely

The Role of Online Personal Loans in Financial Planning

How many times has it happened in life that you need immediate cash/funds but don’t have any? These situations can be overwhelming and overbearing for any individual. To tackle such situations, one can easily apply for an online personal loan and get easy, quick access to funds. In case of any financial emergency, these online

The Importance of KYC When Taking a Personal Loan Online

Introduction With advanced technologies and newly developed online platforms, applying for an online personal loan has become simple and easy for all the users. At the convenience of their home, now users can apply for a personal loan, with a minimum documentation and quick processing time as well. In the overall process of personal loan

How to Apply for a Personal Loan Using Your Aadhaar Card

Introduction In India, the financial market is transforming with the integration of advanced technologies. Be it digital platforms or automation, making the process of loan application simple, easy and convenient for the users. Another use of technology is applying for personal loans using aadhar cards. These aadhar card loans are another simple convenience for the

Step by Step Guide to Applying for an Instant Personal Loan

We are living in a fast-paced world, where everything is turning digital and is supposed to be done within minutes. All the processes are transformed into digital processes, making it convenient for the users. These digital processes can be observed in almost all sectors and industries such as banking. You can now avail instant loans

How to Improve Your Credit Score Using Short Term Loan Apps

In the world of personal finances having a solid credit score while applying for a short term loan can help you with the process. For availing these loans, there are various short term loan apps available in the market that you can explore. One of the leading and trending short term loan apps these days

The Role of Credit Score in Instant Loan Online Approval

In today’s digital era, getting instant loans online has become quite a convenient and suitable approach for most individuals. Not only is this a quick approach but is also hassle free for all those who are seeking quick financial solutions. Be it a financial emergency, an investment or any personal expense, these instant quick loans

Common Mistakes to Avoid When Applying for a Loan

There are instances when borrowing money is the only option and there is nothing wrong with that. However, making such decisions randomly or in a rush may be a bad idea. Before you apply for a loan, you need to consider various factors in order to make the right choice. Before you start applying, it’s

5 Common Myths About Personal Loan Debunked

In the world of personal finance, personal loans are often connected with various misconceptions. These personal loan myths can lead to making wrong and uninformed decisions. It is essential to have a clear understanding of personal loans and get rid of common misunderstandings related to them. Here in this blog, we will debunk some of

FatakPay’s Personal Loans: A User’s Journey

Introduction: Praveen receives a salary and pays for all the bills and essentials, but then, at the end of the month, he is out of money. He still needs to buy more stuff, but Praveen has to wait for next month’s salary due to a lack of funds. Somewhere, we have all been in Praveen’s

The Future Of Corporate Spending: Virtual Credit Cards

If by reading the title, you are thinking, ‘What is virtual credit?’ ‘Is it even useful?’ Don’t skip this blog Cause we have covered everything you need to know. Let’s start with an instance: When in the morning you are leaving your house, you make sure that you keep all of your essential stuff. Like

How to Simplify Financial Workflow?

This blog is about Simplify-ing Financial workflow, but before that, let’s create a healthy morning routine with a scenario: You wake up and go to the gym at 7 am. Then, while returning, you have a coffee from a cafe. Next, you buy some vegetables, cook, and eat your breakfast. Last but not least, you

Mastering The Art of Budget For Long Term Wealth

When we go on a trip, we plan everything: when to depart, reach where, what clothes are needed, etc. Everything is so organized, so why not manage your expenses? Financial stability is essential, and making a budget is the best way to help you create financial stability. Budgeting is a fundamental pillar that you can

Smart Ways to Manage Personal EMI loans

There are situations where a significant amount of money is required, such as for home renovations or purchasing a vehicle, and the most desirable loan option in such cases is Equated Monthly Installments (EMI). Using an EMI loan, one can easily make expensive purchases and pay them in affordable instalments. However, handling such large sums

Advance Salary or Personal Loan? A Quick Comparison

When considering financial assistance, two common options that come up are advance salary and personal loans. Both options have their pros and cons depending on the situation. If you’re looking for more flexibility and larger amounts, a fatakpay personal loan might be more suitable. The blog offers a thorough side-by-side comparison to empower you to

Mindful Spending: For secure Financial Future in 2025

You must always be mindful of your spending, especially if you wish to save for future financial wellness. You will refill the oil in the vehicle only when it’s required. Then why spend the money when it is not needed? When and where you spend your money affects your future savings; mindful spending can effortlessly

Tax planning for Financial wellness

Knowing you have enough money to live freely even after retirement is fantastic. With perfect Tax planning, you can achieve ideal financial wellness. Tax preparation and financial health are essential to ensure your future financial security. It is inextricably intertwined since adequate tax preparation can significantly affect economic well-being. This blog post will examine the

Insurance and Risk Management- Key Strategies To Understand

In today’s world of uncertainty, insurance and risk management have become crucial pillars of financial stability for everyone. They act as protective shields against the unknown and unpredictable, providing a sense of security and peace of mind. For both you and corporations, they serve as the foundation of financial stability. In this blog, we will

Investing for Financial Wellness

Who wants to avoid achieving financial wellness? A feeling of contentment and peace of mind comes with having the resources to live your desired life. And investing is the key to unlocking this financial freedom. Whether you dream of buying your own home, funding your children’s education, or luxurious retirement, investing can help you get

How To Improve Your Credit Score Fast

Credit Score are more than numbers; they judge your ability to obtain finance. It decides whether you get a 20000 loan on aadhar card, or even an interest rate that is competitive with yours. Nevertheless, many individuals need help comprehending the intricacies of credit scores and how to enhance them. We’ll be exploring the fascinating

Small Business Financing Options

Imagine you have started a small business. You want to open a general store in your area, where you could sell basic ration stuff or regular household stuff, but you need a suitable funding solution for your business. Launching costs, controlling cash flow, and funding expansion are some Financial challenges you may face. If you

Smart Financial Planning: Strategies to Secure Your Future

If you have financial planning, any financial emergency won’t be a problem. For instance, if your car broke down unexpectedly at the end of the month when most people are short on cash, you would already have an emergency fund and be able to fix it immediately without worrying about money, and emergency funds is

How to Check Your Provident Fund Balance?

The Employee Provident Fund (EPF) is a government-mandated savings scheme designed to provide financial security and stability to employees during their retirement. It is crucial for individuals to regularly monitor their EPF balance to ensure they are on track to meet their financial goals. In this blog post, we will guide you through the process

What is Senior Citizen Savings Scheme?

Senior Citizen Savings Scheme, or SCSS for short, is a government-sponsored savings programme for people over 60. This programme was launched by the Indian government in 2004 with the goal of giving retirees a reliable and secure source of income during their post-retirement years. It is one of the most profitable savings plans in India

What is ULIP?

Unit Linked Insurance Plans, often known as ULIP, enable you to combine insurance and investing into one product. It gives you a life insurance policy and enables you to profit from the stock market, debt funds, or possibly both, depending on the circumstances. Since its founding in 1971, ULIPS has advanced significantly. The Unit Trust

What is ELSS?

As the tax-saving season approaches, investors often look for investment options that offer tax benefits and help them create wealth in the long run. Equity-Linked Savings Schemes (ELSS) an investment option offering tax benefits under Section 80C of the Income Tax Act, 1961, and providing an opportunity to invest in equity markets. This blog will

What is TDS?

Introduction to TDS: TDS, or Tax Deducted at Source, is a portion of a person’s monthly income that is taxed as soon as it is received.It is applicable to all forms of income and is paid to the Indian Central Government. There are 27 sections under Tax Deducted at Source, each with a particular deduction

What is Digital Signature Certificate?

Introduction to Digital Signature Certificate: The Ministry of Corporate Affairs (MCA) launched the MCA 21 project with the following goals: Forms should be e-centric, simplified, and online transactions should be encouraged. This is where Digital Signature Certificate comes in. Prior to the execution of this project, the processes for classifying, storing, and retrieving paper-based records

What is TPA And Its Role in Health Insurance

Introduction to TPA: Have you ever had to admit a loved one to the hospital on short notice? Though unpleasant, it is a difficult and inescapable aspect of our lives. You rush to get medical help when accidents happen or incidents occur that require emergency hospital care. Those who have insurance policies can take a

Types of Loans

In essence, a loan is money that is lent with the assurance that it will be paid back over time. Your obligation to pay interest on any borrowed funds is established by the lender. coupled with the borrowed main sum. These are several types of loans that are offered in India. Various types of loans:

What Is a Personal Loan? A Simple Guide for First-Time Borrowers

When unexpected expenses arise or planned goals need quick funding, a personal loan often becomes the go-to financial solution. But before applying, it’s important to clearly understand what is a personal loan, how it works, and whether it suits your needs. This guide breaks down the personal loan meaning, features, benefits, and key considerations in

The Evolution of Lending (Part 2)

Quick Recap of Lending: The process of Lending involves an individual, a group (public or private), or a financial institution, which makes funds available to a person or business with the expectation that the funds will be repaid. In Part 1 we covered Lending in the Ancient and Middle ages across various geographies. In Part

The Evolution of Lending- From Old to New Age (Part 1)

Introduction to Lending: Lending is an age-old practice that has been a part of human civilization since ancient times. In the process of Lending, an individual, a group (public or private), or a financial institution makes funds available to a person or business with the expectation that the funds will be repaid. The concept of

Mutual Funds vs ETFs

Introduction: ETFs and Mutual Funds have quite similar characteristics. Its functionality and related risks vary, nevertheless. To make an informed choice, be aware of these variations. Mutual funds and ETFs both share some characteristics. But, there are several significant distinctions that define ETFs and Mutual Funds apart. They both possess a wide range of distinct

Understanding the Different Types of Investments: Stocks, Bonds, Mutual Funds

It is often said that don’t put your eggs in a single basket. People usually interpret this statement as ‘not putting money in a single stock’. That interpretation is not entirely wrong, however, it does miss a crucial point. A better interpretation of this statement is that don’t put your money entirely in the stock

The Right way to plan your Retirement

Whether you are young or slightly old , old age is sooner or later gonna affect all of us. Retirement might be a long way ahead, but planning beforehand will make sure that your old age is as smooth as your present age. In this blog, we talk about ways in which you can plan

The Smart Way to use Credit Cards

Ever wondered why banks keep pushing users to sign up for credit cards? Does it make you think whether having a credit card really has its advantages? Let’s venture deeper into the blog to understand The Smart Ways of Using Credit Cards. First let us understand about the term Credit Card and how different it

What is insurance? The role of insurance in protecting your finances.

Insurance is a financial tool that helps protect you from unexpected events. It gives you peace of mind and provides you with the confidence to face a situation if something unexpected happens. Whether it is a car accident, a natural disaster, or a serious illness, insurance can help you avoid financial ruin. At its core,

The Psychology of Money: How Our Minds Impact Our Spending Habits

Money is a funny thing. It can bring us joy and security, but it can also cause stress and anxiety. And while we like to think that our spending habits are rational and logical, the truth is that our emotions and psychology play a huge role in how we handle our money. One of the

Need for financial security in today’s inflation-recession economy

Financial security is a key concern for many people in today’s economy. With inflation on the rise and the threat of recession looming, it’s more important than ever to make sure that your financial situation is stable and secure. There are several reasons why financial security is important in today’s economy Inflation: Inflation is a

How to manage your Personal Finance?

Do you know where your money is? Are you able to regularly track your expenses? If not, then understanding your Personal Finance will help you manage your funds in a better way. Most people will measure their personal cash flow on a monthly basis. They’ll look at how much they’ve made and how much they’ve

What is a Credit Score and how does it affect your chance of getting a loan?

Are you ready to take control of your credit and achieve the financial freedom you deserve? Your credit score is the key to unlocking a world of financial opportunity, from low-interest loans to credit cards with generous rewards programs. But what is a credit score and how is it calculated? Your credit score is a

Financial Wellness: Expectations & Reality

Financial wellness is an umbrella term that refers to effectively managing your economic life, and it encompasses a wide range of concepts, such as keeping spending within your means, being prepared for emergencies, having access to the information necessary to make good financial decisions, and having a plan for the future. But according to a

The Next Big thing in Financial Wellness

If there was a silver lining to the Covid-19 pandemic, it was many of us realizing the importance of taking care of ourselves. At least 80% of the general population started engaging in some form of self-care after the pandemic. The same is applicable to our financial health as well. It was during and after

How to Promote Financial Wellness in your workplace

The health and happiness of its employees are a priority for any company. Therefore, businesses are spending more on employee wellness programs to ensure healthy bodies and minds that, in turn, provide superior output. While the aspect of health has been downplayed in the past, here are some reasons why financial health is essential to

What Is Credit Score Range & How To Read It?

Introduction A credit score plays a crucial role in determining your creditworthiness. Whenever you Apply for a personal loan online, banks or Non-banking financial institutions will evaluate your credit score while deciding whether to lend you money or not. The credit score also influences the loan amount to be sanctioned and the interest rate to

What is a credit score and how to improve it with FatakPay?