In today’s fast-paced and financially dynamic world, millennials are embracing smarter, more flexible ways to handle money. Among these, instant personal loans and personal loans stand out as powerful tools that can help bridge gaps, unlock opportunities, and even build long-term financial credibility. Digital lending platforms like FatakPay are leading the change, making borrowing not only convenient but also a step toward financial empowerment.

What Are Digital Loans?

Digital loans are financial products offered through online platforms and mobile apps without the traditional paperwork or physical visits to a bank. They are processed quickly, often with instant disbursal after verification.

There are generally two main types:

1. Instant Loans

These are for smaller amounts, typically up to ₹20,000, designed for very quick access. They come with short repayment terms, usually between 30-45 days, and can have a relatively higher interest rate (up to 36% per year) due to their short-term, unsecured nature. Instant loans are best suited for short-term needs and can be a quick fix to tide over minor financial hiccups like emergency expenses, salary shortfalls, urgent travel, or utility bills. They offer rapid approvals and minimal documentation.

2. Personal Loans

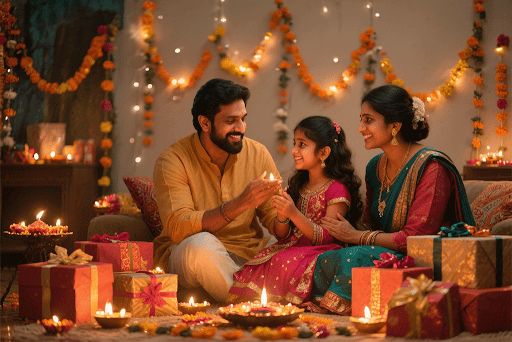

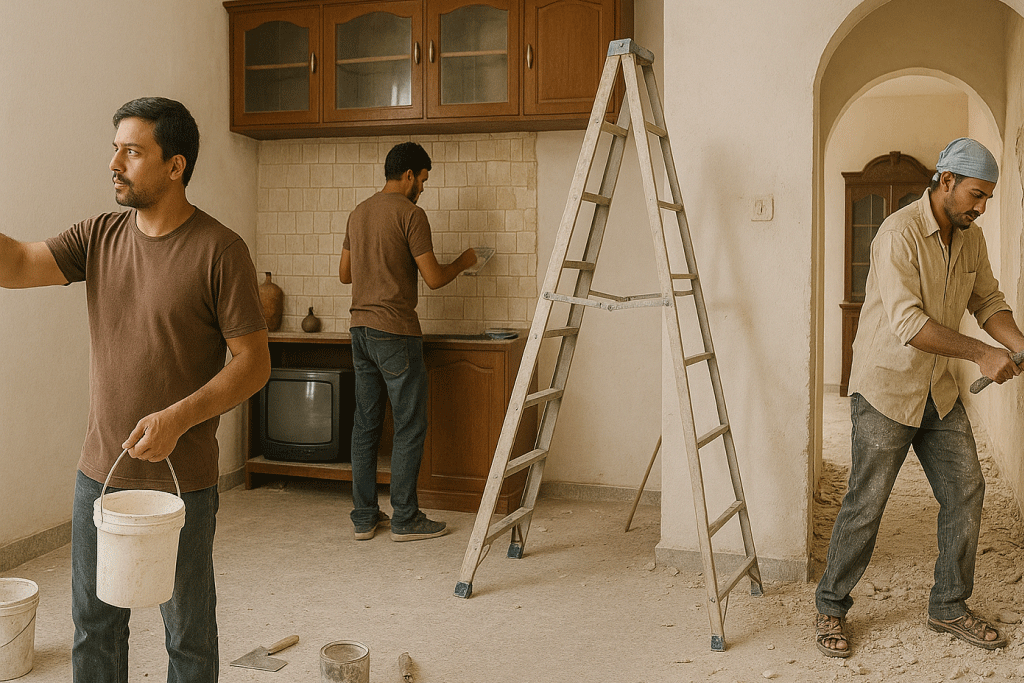

These cater to larger financial needs, offering amounts up to ₹5 Lakh. The repayment terms are more extended, ranging from 3 to 36 months, and you can find competitive interest rates as low as 15% per year, depending on your eligibility and financial profile. Bigger goals like home renovation, debt consolidation, wedding expenses, or medical emergencies.

Personal Loan as an Important Financial Wellness Tool

Opting for a personal loan or instant loan is not just about meeting immediate needs, it can be a part of a bigger strategy to improve your financial health. Here’s how:

1. Helps Build Your Credit Score

For millennials establishing their financial footprint, taking out an instant loan or a personal loan and repaying it diligently is an excellent way to build a strong credit history.

Timely repayment of loans, even small ones, gets reported to credit bureaus. Over time, this boosts your creditworthiness and opens up better financial products in the future.

2. Bridges Short-Term Cash Crunches

Instead of dipping into savings or borrowing from friends, a short-term instant loan can fill in the gap efficiently during low cash flow periods.

3. Enables Financial Wellness Through Ancillary Benefits

FatakPay goes beyond just lending. They offer additional services that contribute to your overall financial wellness. This can include avenues to secure insurance (such as accidental coverage up to ₹10 Lakh), opportunities for digital gold investments, and more.

4. Unlocks Higher Credit Limits Over Time

Start small, build trust. By taking and repaying a small instant loan on time, users can become eligible for higher loan amounts in the future with FatakPay.

This leads to an increase in your eligible credit limit which gives access to financial freedom encouraging discipline and rewarding responsible financial behaviour.

Adulting Deserves & Needs Backup

With increasing access to tech-based financial tools and rising aspirations, millennials are uniquely positioned to take advantage of digital lending solutions. Whether it’s an instant personal loan to tackle today or a long-term personal loan to plan tomorrow, FatakPay empowers users to make informed and responsible borrowing decisions.

Remember to assess your personal loan eligibility, use tools like a personal loan calculator on how to manage loan EMIs, and most importantly, stay disciplined with repayments. A smarter approach to borrowing today can pave the way for a stronger financial future.