Digital gold has steadily become a preferred investment option for millions of Indians, thanks to its simplicity, transparency, and low entry barrier. Whether you’re a new investor or someone looking to diversify, understanding how gold prices in 5 years have moved is essential to making informed decisions.

The last five years have been particularly eventful for global markets—from the pandemic to inflationary spikes and geopolitical tensions—all of which have significantly influenced gold prices.

This article breaks down digital gold trends, gold prices in 5 years history in India, and what these movements mean for investors today.

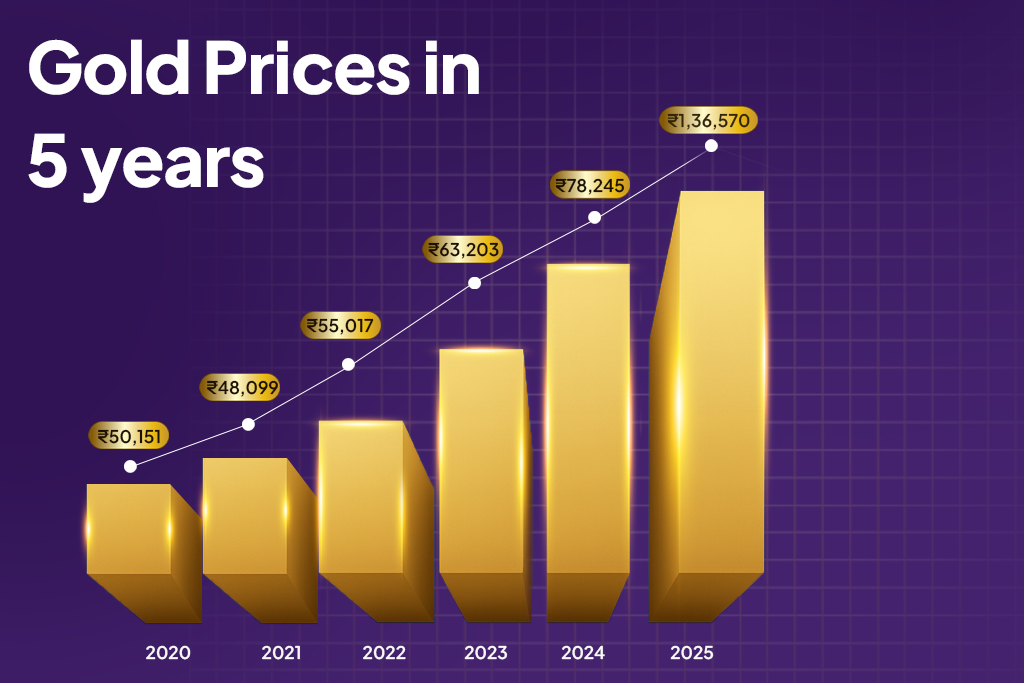

A 5-Year Snapshot: Gold Price Trend in India (2020–2025)

Gold prices have shown strong upward movement between 2020 and 2025, reinforcing its position as a long-term wealth protection asset.

Here is a simplified 5-year gold price chart (average prices for 24K gold):

| Year | Approx. Avg. Price (₹/10gram) |

|---|---|

| 2020 | ₹50,151 |

| 2021 | ₹48,099 |

| 2022 | ₹55,017 |

| 2023 | ₹63,203 |

| 2024 | ₹78,245 |

| 2025 (YTD) | ₹1,36,570.00 |

Note: Source of gold prices are from Forbesindia

Key Insights

✔ Gold prices increased approximately 130–140% over 5 years

✔ Price correction in 2021 was temporary, followed by strong recovery

✔ The highest jumps occurred during 2024–2025 due to global instability

This consistent upward movement highlights why digital gold continues to attract long-term investors.

What Drives Gold Price Changes: Key Factors Over 5 Years

Gold is influenced by multiple domestic and international forces. The past five years show clear patterns:

1. Global Economic Uncertainty

The COVID-19 pandemic, recession fears, and sluggish growth pushed investors towards safer assets like gold.

2. Rising Inflation Worldwide

As inflation rose, households sought inflation-hedging assets, boosting demand and prices.

3. Rupee Depreciation Against the Dollar

A weaker rupee increases the cost of importing gold, pushing domestic prices higher.

4. Geopolitical Instability

Events such as conflicts, oil price fluctuations, and war threats lead to quick spikes in gold rates.

5. Increasing Digital Gold Adoption

Digital platforms made gold accessible to the masses, increasing small-ticket investments significantly.

These factors collectively influenced the gold price trend in India and contributed to its stability as an investment.

What This 5-Year Trend Means for Digital Gold Investors

The upward trend in gold prices brings several insights for present and future investors:

1. Reliable Long-Term Growth

Despite short-term dips, gold has maintained steady appreciation.

2. Ideal for Small, Consistent Investing

Digital gold allows investors to purchase tiny quantities regularly, perfect for SIP-like wealth building. You can also use SIP calculator to plan gold investing and estimate how small, consistent contributions grow over time.

3. Strong Portfolio Diversifier

Adding gold reduces overall investment risk due to its low correlation with equities.

4. Easy Liquidity & Flexibility

Digital gold can be bought or sold instantly at live market rates, unlike jewellery or physical gold.

5. Perfect for First-Time Investors

With no storage costs, purity concerns, or minimum investment amounts, digital gold is accessible to everyone.

What Investors Should Know: Limitations & Considerations

While digital gold offers several advantages, investors should be mindful of:

1. Short-Term Volatility

Daily price variations are normal, long-term patience matters more.

2. Storage Time Limit on Some Platforms

Some platforms allow free vault storage for up to 5 years.

3. No Fixed Income

Gold doesn’t generate interest; returns depend entirely on market trends.

4. Taxation Rules

Capital gains tax applies if digital gold is sold after three years.

Understanding these limitations will help you make better investment decisions aligned with your financial goals.

Start Your Digital Gold Journey with FatakPay

Invest in one of the world’s most trusted assets, easily, securely, and from as low as ₹10. Invest in digital gold today and start building a portfolio that grows with the market.

Download FatakPay and start your digital gold investment today.

Smart investing begins with small, consistent steps.

FAQs

1. What is the gold price trend in India over the last 5 years?

Gold prices have risen by 130–140% from 2020 to 2025, reflecting strong long-term stability.

2. What are the benefits of digital gold?

Instant buying/selling, secure storage, guaranteed purity, and the ability to invest small amounts.

3. Is digital gold profitable long term?

Yes, historically gold has offered steady appreciation, making digital gold suitable for long-term wealth building.

4. Who should invest in digital gold?

Beginners, long-term savers, and anyone seeking a safe diversification asset.

5. Where can I buy digital gold?

You can easily buy secure, 24K digital gold through the FatakPay app.

| Personal Loans by City | ||||

|---|---|---|---|---|

| Personal Loan Bengaluru | Personal Loan Thane | Personal Loan Mumbai | Personal Loan Hyderabad | |

| Personal Loan Pune | Personal Loan Surat | Personal Loan Coimbatore | Personal Loan Delhi | |

| Personal Loans by Amount | ₹60,000 Personal Loan | ₹3 Lakh Personal Loan | ₹5 Lakh Personal Loan |

|---|