Introduction to Nifty 50:

Want to learn more about the Nifty 50 index and how it impacts the Indian stock market? Our blog provides a detailed analysis of the Nifty 50, including its history, composition, and performance. Whether you’re a seasoned investor or just starting out, our blog on Nifty 50 is a must-read for anyone looking to understand the Indian stock market.

What is Nifty 50?

Nifty 50 identifies with India’s largest listed companies and presents itself as a key barometer for gauging the long term health of the Indian economy. It represents the weighted average of India’s top 50 companies that are listed on the National Stock Exchange. Nifty 50 is the abbreviation for National Stock Exchange 50. Besides, Nifty 50 is a market index but like any other and like any index it represents a portfolio of investment holdings which happen to be the bluest of the blue chip companies. At times, the Nifty 50 can represent 55-60% of the total market capitalization.

The Nifty’s importance in the financial markets also allows for many innovations. For instance, a number of mutual funds use the Nifty 50 as the benchmark. In fact there is an entire ecosystem around the Nifty which includes onshore and offshore ETFs, Exchange Traded Options, Futures and a host of other services making the Nifty 50 the world’s most actively traded contract.

The Nifty, Then and Now:

The National Stock Exchange introduced the Nifty in 1996, so it is just over 25 years old. 75% of the companies which were listed in the original Nifty 50 (1996) do not exist in the Nifty 50 as of now! If we compare the composition of the Nifty 50 in 1996 to the composition of Nifty 50 now, we can see that as a country we have moved from being a manufacturing economy to a services one over the last 25 years. The point is that the companies that represent the Nifty do change and the index has seen a 100 changes in its constituents over the last 25 years.

How are Nifty 50 stocks selected?

The Nifty 50 has a very well defined and transparent methodology to select the constituent companies.

- The Universe of Companies

- The Basic Construct

- The Liquidity Rules

- The Rebalancing and Reconstitution Rules

- The Universe of Stocks:

The company should be listed on the National Stock Exchange (NSE) for it to be a part of the Nifty. The company should also be available for trading in the NSE’s Futures and Options segment.

- The basic construct:

The selected companies have to be in the top 50 companies in terms of their free float market capitalization. Free float means those shares or the proportion of the capital that is publicly traded. Publicly traded means that anyone can buy or sell shares and they are not blocked by company insiders like promoters, strategic partners, employee welfare trusts, or even the government.

- Liquidity:

Those companies are considered which have a very high trading volume.

- Semi-annual rebalancing exercise:

This process happens in June and December every year. The above exercise is done so that we can get an accurate representation of India’s largest and finest companies.

Performance of the Nifty:

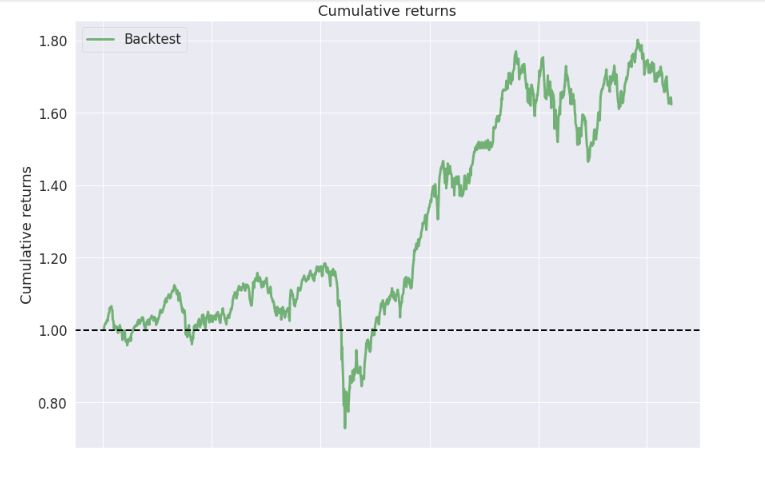

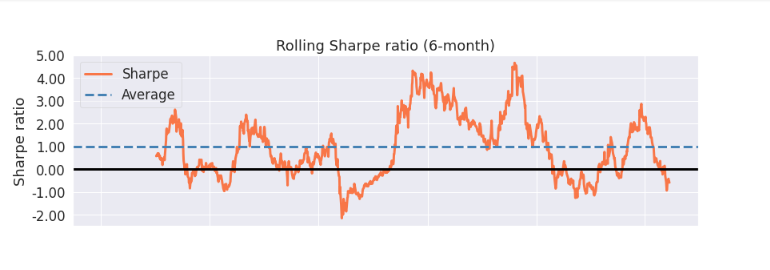

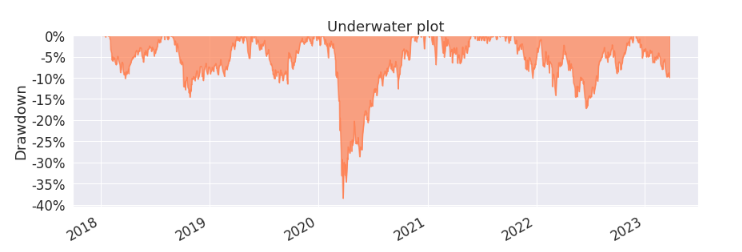

To measure the performance of this index, we have analysed the returns for 5 years in Python. The data was collected from Yahoo Finance. The Start date of the analysis was 2/1/2018 and the end date was 23/3/2023.

We will look at the cumulative returns, the rolling sharpe ratio and the drawdowns graphically.

The Sharpe ratio = Returns/standard deviation. Standard deviation is used as a measure of risk. The time duration window of the rolling Sharpe ratio is 6 months.

A drawdown refers to how much an investment is down from the peak before it recovers back to the peak.

The Cumulative returns in the last 5 years was 62.3%.

The Sharpe ratio for 5 years was 0.59

The maximum drawdown for Nifty in the last 5 years was 38.4%

How to Invest in the Nifty?

There are 2 ways to invest in the Nifty:

- Buy Stocks in the same percentage of its composition in the Nifty.

- Invest in an Index Mutual Fund that tracks the Nifty.

Most investors prefer option 2 due to its ease of access.

Additional links:

We hope you enjoyed reading this article. Do check out our other blogs and articles as well.

https://www.linkedin.com/pulse/rise-fintech-its-impact-traditional-financial-institutions-fatakpay/

https://www.linkedin.com/pulse/budget-2023-simplified-fatakpay/

About FatakPay:

FatakPay provides virtual credit facilities for all. It’s available on your phone and caters to your everyday needs in both online and offline formats. Payments are done seamlessly through UPI/QR codes. The solution provides an almost zero cost, free, quick, transparent and secure way to transact in a multilingual format with a Scan Now, Pay Later facility and easy repayment options.

Link to FatakPay App: https://play.google.com/store/apps/details?id=com.fatakpay

Link to the Website: https://fatakpay.com/